This is a fairly long post that was driven by conversations with a wide variety of colleagues. All errors are my own.

Cognitive science has discovered a great deal about how learning works, and by extension, what leads to effective teaching. From the evidence available, relatively few higher education faculty, at least at 4-year institutions, incorporate these findings into their teaching. Many colleges and universities claim to value quality teaching, often stating that it is their number one priority (e.g. for tenure and promotion). Why then do they not perceive, or more importantly, act on the disconnect between what is known about effective teaching and how higher ed instructors actually teach? Why do colleges and universities feel no compulsion to seriously address that disconnect, when the literature shows that teaching is a learnable skill; that good teachers are made, not born?

At 4-year colleges and universities, the assumption is that all (or nearly all faculty) are effective teachers. By implication, instructors must use effective teaching practices (e.g. not over-reliance on lecture), and thus, teaching quality is assumed to be good (enough).

Contrast this with the fact that few new Ph.D.s received serious training in learning science, which implies that, at least initially, new faculty are unlikely to be excellent teachers. Much as faculty expect incoming students to know how to do college-level writing, or at least to pick it up on their own, incoming faculty are expected to pick up teaching talents through experience, with occasional programs offered by their school, though the majority of faculty do not participate in these programs.

Some say there is no evidence of a problem. [Inside joke: How many free market economists does it take to screw in a lightbulb? Answer below.] There is limited information on how faculty actually teach. In my discipline, economics, the most recent evidence suggests that lecture remains the dominant pedagogy. This appears to be also true in the natural sciences and some other disciplines, such as history. I’m not trying to criticize specific disciplines; just to note that lecture is still widespread.

Do institutions really want to know how effective their teachers are? Are they prepared to deal with the consequences? Suppose an administration undertakes a poll to determine how prominent effective teaching practices are among its faculty. Suppose they discover that effective teaching practices are not the norm. What does the administration do then? Maybe ignorance is the smarter course.

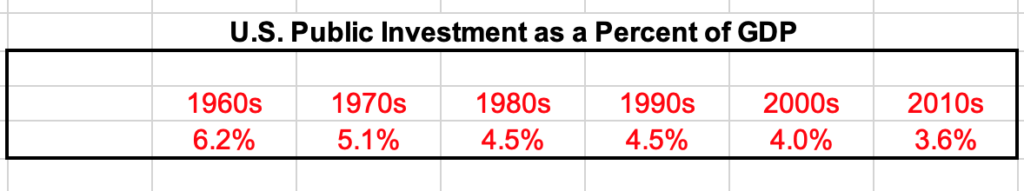

Perhaps administrations don’t see the benefit of improved teaching. If most teachers do a good job so that the room for improvement is small, while the cost of teaching development is large, the perceived marginal benefits may not be worth the cost. Has any institution explored this question seriously? Or is it another lightbulb joke? What institutional metrics could show the effects of improved teaching? Consider student success metrics, like completion rates. For students who started full time in 2012 at 4-year institutions, the national average 6-year completion rate was 66%. Note that this was before Covid. For my state, Virginia, the figure was nearly 80%. These are very noisy statistics, meaning the margin for error is high. Would improved teaching effectiveness significantly increase completion rates? Would it reduce the number of students dropping out for academic reasons or transferring? It seems like the potential benefit could be large (e.g. up to 20%). Even 5% improvement would be significant, especially for those students involved.

The problem is how we assess teaching effectiveness!

We don’t know how to measure teaching quality with precision. Education is a complex process with multiple inputs and multiple outputs, making it challenging to determine the effects of a specific innovation, be it a new pedagogy or the effectiveness of an instructor in a single course.

There is more than one type of effective teaching. Some teachers are better in one context than in others. Some teachers are better with introductory students; some are better with advanced students. Some shine at helping students in trouble. Others excel at making sure all students reach a particular standard. Some are better with small groups; some with large groups, etc. Do these faculty get assigned to where their teaching is most effective? Sometimes yes; sometimes no, since a specific teacher’s comparative advantage isn’t always the most important determinant of their teaching assignments.

Serious teaching assessment is time and resource intensive. By contrast, most assessment gets dumbed down to the lowest common denominator that we can quantify. At most schools there is over-reliance on student course evaluations, which can be better or worse, and which have known biases. As one department chair told me “Course evals will only give you low-res[olution] assessment.” How many chairs and deans consider the biases in their evaluation of teachers? How many consider whether differences in student course evaluation scores are statistically significant?

We don’t have a good quantitative measure of teaching effectiveness. How about qualitative measures? Department chairs play a critical role in teaching evaluation. Chairs who take teaching evaluation seriously can identify teachers’ strengths and weaknesses and they can differentiate between good and poor teachers. A casual survey of department chairs suggests that good teachers can judge good teaching, because they’ve internalized the multiple dimensions. What would a complex, multi-environmental assessment look like? It would involve reviewing course designs, multiple class visits, grade distributions and well-designed course evaluation results, ideally by more than one reviewer. What would we hope to learn from this assessment? What would its value-added be over student course evaluation data? Ideally, it should identify directions for improving teaching effectiveness, based on evidence-based instructional practices.

But consider a school which does not use professional chairs, that is, chairs selected for their management and leadership ability. It is not uncommon for schools to rotates the position around each department, regardless of one’s ability to chair. Ideally, chairs would act based on what’s best for the department, but chairs are human beings. If you are an associate professor, would you feel comfortable being critical of a more senior colleague’s teaching? If you are not yet tenured (and some department chairs find themselves in that position), would you be able to critically judge the teaching effectiveness of colleagues who will be expected to write letters for your tenure application? Imagine further that chairs have little or no training. Why should we expect them to put themselves out?

Should course evaluation be summative or formative? Summative evaluation should be able to determine if an instructor employs effective teaching practices or not, using a holistic approach. This is what good chairs do. But summative evaluation is likely to never be more than a rough judgment, suggesting that fine gradations are problematic. By contrast, formative feedback can improve teaching practice. Imagine a scenario where experienced teachers are invited to review one’s teaching. These reviewers would provide “peer commentary,” which could be better received than “assessment.” Teachers could choose to include such commentary in their annual review documents, but they would not be required to. Imagine if peer commentary was perceived by the faculty member analogous to the review of a journal submission. The faculty member should recognize and accept that other, more experienced colleagues may have useful insights that are worth taking seriously. The idea would be for the teacher to take what they think is valuable to incorporate into their teaching. To effectively get “credit,” say for annual evaluation, tenure or promotion, the teacher would have to report the commentary as well as their response to it. Of course, this would require buy-in from faculty, chairs, P&T committees and deans to more carefully evaluate teaching effectiveness.

College teachers are conservative about pedagogy. They need compelling reasons to make changes to the way they teach. A long time colleague asserted that he was an effective teacher and until he saw evidence to the contrary, he saw no reason to change. He was a good teacher, but he could have been even better.

Absent training in graduate school about pedagogy, faculty tend to teach the way they were taught, which often means lecture. There is a place for lecture, but to reach most students, lecture shouldn’t be the only pedagogy or the most dominant one.

According to a recent Chronicle article, “When STEM courses are taught using active-learning techniques rather than a standard lecture, students perform better, according to a widely cited meta-analysis … published in the Proceedings of the National Academy of Sciences journal.” In addition, “[W]hen much of class time is devoted to active learning, it reduces gaps in student performance.”

Changing one’s teaching from predominantly lecture to something more active is usually perceived as a very heavy lift. For experienced faculty, who have taught a variety of courses, changing one’s pedagogy in all their courses can be an immense challenge. Where will they find the time and energy given their already heavy workload? The answer is similar to the joke about how one eats an elephant. The answer is one bite at a time.

A colleague told me “Okay, I know that active learning techniques are more effective than lecture, but what would active learning look like in my [insert discipline] classroom? I need specific ideas–I don’t really know where to start.” This is where most higher level discussions of improving teaching practice fall short. The best way to change one’s pedagogy is one step at a time. Start, for example, with an exit-ticket at the end of class. That doesn’t change anything other than the last few minutes of each class section. See how that works and then add something else.

Conclusions

How might an institution’s strategic plan (and programs & policies stemming from that plan) be different if, instead of assuming that all faculty are good (enough) teachers, it was assumed that all faculty could improve their teaching effectiveness and that improvement would enhance student success in a measurable way?

The evidence seems clear that faculty will improve their teaching effectiveness when they adopt evidence-based instructional practices in their courses. How can that be facilitated?

According to Cathy Davidson, the fundamental impediment to teaching improvement is lack of incentives for faculty to change. Faculty earn credit for scholarly publications. They earn almost nothing for improved teaching. Publications can be counted and weighted. Teaching innovations are not.

Current teaching evaluation is designed to, at best, weed out the really poor teachers. A better approach would be to help all teachers improve their practice. How can this be accomplished?

Evaluation of teaching should be enhanced to change the focus from summative assessment to formative feedback. This can be done using a holistic approach as described above, where the goal is to identify good teaching practice and suggest ways the practice could be improved.

We need faculty development programs that are robust and provide time and perhaps (summer) stipends. Like most things, teaching effectiveness depends on learning and experience. Effective teachers are made, not born.

The best faculty development is immersive. Faculty will change their practice more from participating in an immersive experience than from listening to a presentation. An immersive experience engages participants with genuine work that will be shared with others.

Start with incoming faculty, making the program affordable and doable. Faculty new to teaching tend to be poorly prepared and would benefit from a significant teaching development opportunity, much more than is typically in place. New faculty need more than a one hour session on how to use the institution’s learning management system. They need a week of training during the summer before classes start, or better yet, a semester long-seminar on course design, bringing in good teachers to demonstrate effective practices. That would also be a good way to build community. Ideally, participants should be given a teaching reduction, but also be expected to produce deliverables: If the topic of one month’s meeting is active learning, for the following month participants should bring in one or more examples designed for their courses to be shared and discussed. Requiring deliverables tends to result in much deeper learning, and in this case the products will enhance courses into the future.

Why not teach faculty to be more effective teachers? If we do not, it’s like leaving money on the table. It’s an opportunity missed.

[ Answer to Inside Joke: It takes no free market economists to screw in a lightbulb, because if the lightbulb needed to be replaced, the market would have already done it. ]

Traditional publishers make their profits by exploiting monopoly power. The traditional textbook industry is dominated by a small number of large firms, think Cengage, McGraw-Hill, Pearson. Economists describe this type of industry as an oligopoly, in which the large firms have a significant amount of monopoly power, which has enabled them to increase prices significantly over time.

Traditional publishers make their profits by exploiting monopoly power. The traditional textbook industry is dominated by a small number of large firms, think Cengage, McGraw-Hill, Pearson. Economists describe this type of industry as an oligopoly, in which the large firms have a significant amount of monopoly power, which has enabled them to increase prices significantly over time.

a prominent cognitive psychologist, who readers of this blog will know I’ve followed for some time. Chew’s premise was that students and teachers each have a model of learning in their heads, which guides their actions.

a prominent cognitive psychologist, who readers of this blog will know I’ve followed for some time. Chew’s premise was that students and teachers each have a model of learning in their heads, which guides their actions.